When it comes to businesses, one has to know their options before one starts. There are many routes to do business, and depending upon your needs, they may differ. You can start a business with a number of people, who will jointly invest and own the company, commonly referred to as Limited Liability Company LLC, or you can invest and own a business all by yourself, commonly referred to as Sole Proprietorship.

Each structure has its own merits and demerits, and what route you choose for your business will heavily influence your day-to-day operation. This article will talk about Sole Proprietorship, what it means, its pros and cons, and is it really worth it? Let’s dive in.

What Is A Sole Proprietorship?

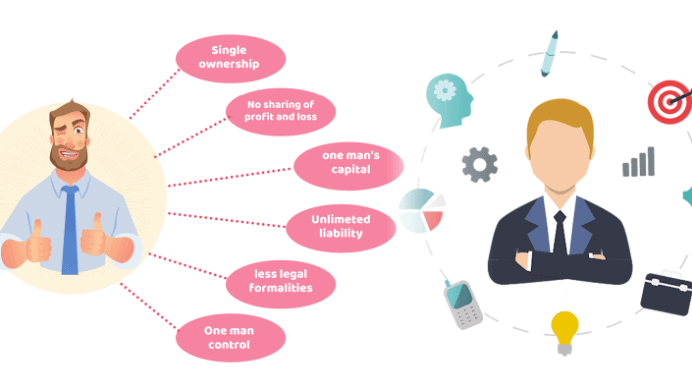

As the name suggests, a “Sole Proprietorship” is a company structure that is owned by a single person. That means when you start a sole proprietorship, you will be liable and responsible for all the investment and operational duties. It is different from a Limited Liability Company (LLC) or a Limited Liability Partnership (LLP), where a separate ‘entity’ is formed to protect the owners/partners from company liabilities.

Key Takeaways

- A sole proprietorship is a company structure that is owned and operated by a single person (owner).

- A sole proprietor is responsible and liable for all the day-to-day operational and legal duties.

Pros

Each company structure comes with its pros and cons, and since we are discussing sole proprietorship, let’s look at some of the pros this company structure has to offer.

Easy to Start

An LLC or LLP is a complex company structure that demands heavy paperwork and legalities. A sole proprietorship, on the other hand, is easy to start and get off the ground. It is the easiest and most convenient form of business due to less paperwork and legal requirements.

Often businesses start from sole proprietorship and then proceed to establish an LLC. Sole proprietor to partnership is another common occurrence in the business world. However, this doesn’t have to be the case. You can be a sole proprietor if it’s convenient for you and your finances.

Tax Benefits

Corporations and LLCs are complex business structures and are bound by tax regulations. A sole proprietorship, on the other hand, is a ‘pass-through’ business that is exempted from corporate income tax. In the case of a sole proprietorship, the owner of the business is only subjected to file individual tax returns, which are taxed at individual income tax rates and are significantly lower than corporate income tax.

Sole Ownership

Perhaps the most rewarding benefit of a sole proprietorship is that you don’t answer to anyone but yourself. Business and financial freedom are something all business owners yearn for. As a sole proprietor, you reap what you sow, giving you the motivation, responsibility, and accountability of your decisions.

However, since you are the ‘sole’ owner of your enterprise, you are responsible for all the day-to-day operations of your business, including account handling, bookkeeping, etc. Sole proprietor bookkeeping may overwhelm you, but there’s plenty of help on the internet to help you deal with it.

Key Takeaways

- A sole proprietorship is easy to start and requires less paperwork and cost.

- A sole proprietorship is exempted from corporate income tax.

- You (the owner) have the financial and business freedom to operate your business.

Cons

A sole proprietorship has its disadvantages as well, and it’s important to discuss them for informed decision-making. So, let’s look at some of the drawbacks of a sole proprietorship.

Unlimited Liability

Since sole proprietorships are not separate business entities like LLCs, the legal ramifications and liabilities fall directly on the owner. For instance, if an LLC fails to repay its debts, the owners are still protected from giving away their personal assets.

However, in a sole proprietorship, this burden falls on the owner themselves, and the creditor may seize the sole proprietor’s personal assets, such as a home. This is precisely why the debate of sole proprietor vs. partnership is relevant to this day, and business enthusiasts struggle to choose due to high accountability.

Funding Issues

Sole proprietorship loans are another issue that you may have to face when getting capital for your business. Unless you are successful in getting personal investment from a friend, relative, or sibling, getting funds from a bank may be difficult since banks and creditors like to work with established companies with solid bookkeeping.

High Risk

There are many elements of business that you need to take care of when you are a sole proprietor. When you are the sole owner and operator of a business, you are bound to falter and make mistakes. Sole proprietorship accounting is one of those elements in which you need to pay your due diligence.

This puts the sole proprietor at high risk. When you are in a sole proprietorship, QuickBooks may be the best option for you to handle accounts and keep track of your expenses.

Key Takeaways

- In a sole proprietorship, all the business responsibility and liabilities fall on the proprietor/owner.

- Getting capital funding may prove to be difficult in a sole proprietorship.

- A sole proprietorship is a high risk compared to LLCs and corporations.

Bottom Line – Is It Worth It?

Is Sole Proprietorship worth it? It depends on who you asks. If you are a self-contractor or a consultant, a sole proprietorship is your best option. However, if your business is scalable and would require expansion, you may start with a sole proprietorship but will have to establish an LLC later on.